This article originally appeared on TheCollegeInvestor.com.

When it comes to how to pay for college, most people think the only option is to take out mountains of student loans. But they should actually be your last option. Student loans accrue a lot of interest and take years to pay off. A study from the One Wisconsin Institute found that it takes graduates of Wisconsin universities 19.7 years to pay off a bachelor's degree and 23 years to pay off a graduate degree.

Knowing that student loans will likely still be a source of funding, there is a certain order of operations to follow when seeking out funding sources for college. After reviewing your financial aid award packages, you'll have to think about how you're going to pay for school.

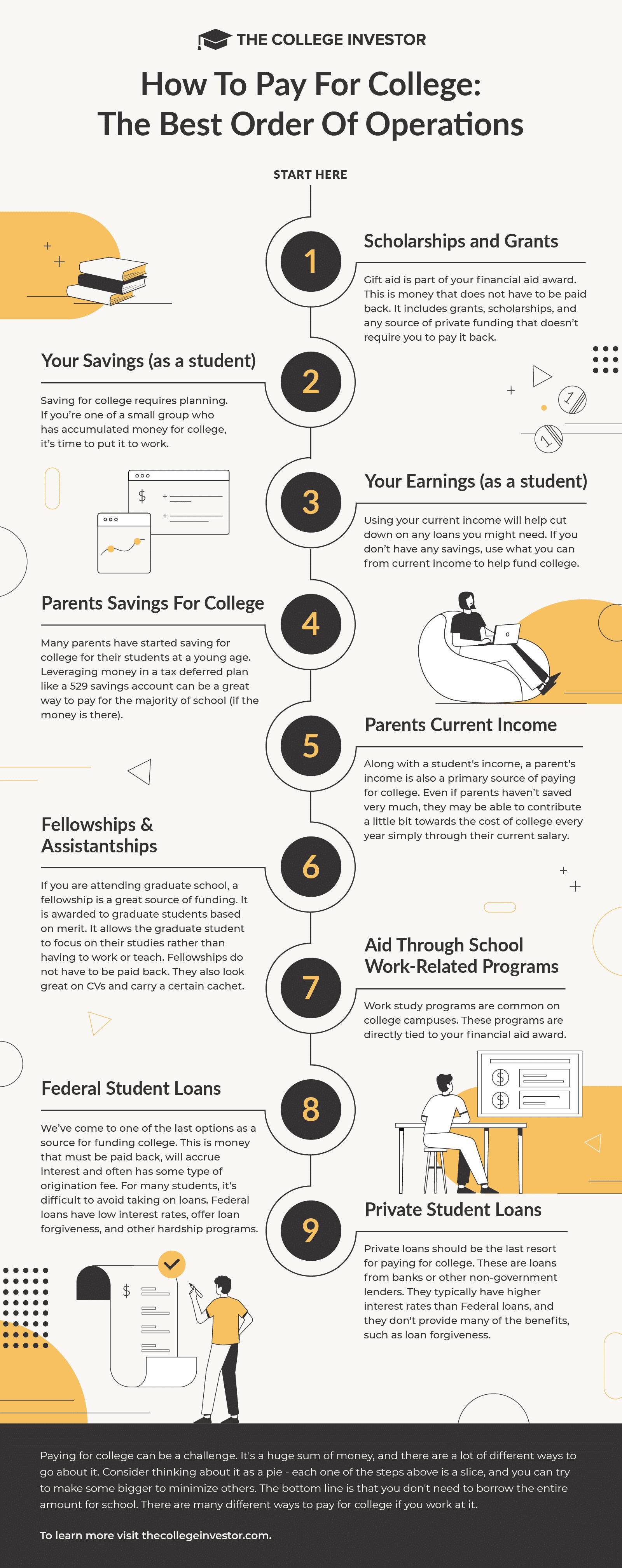

Paying for college: The ideal order of operations

In the infographic below, we’ve provided the main groups of funding sources. Start with the top group and work your way down to the last (i.e., worst) option, which is student loans. By following this guide, there’s a chance you can reduce the amount of student loans needed to finance college. For a lucky few, student loans may not even be necessary.

It's important to note that this is more like a "pie" than a strict order. The more you can contribute from the previous slices, the less you'll have to borrow. And there are no strict rules here, but you should use free money before other funds whenever possible.

Infographic by The College Investor

1. Scholarships and grants

Gift aid is often part of your financial aid award package. This is money that does not have to be paid back. It includes grants, scholarships, and any source of private funding. Don't forget to apply for private scholarships and grants—don't just depend on your school. This sounds crazy, but I recommend high schoolers apply to at least 50 scholarships, even if you're planning on being a part-time student.

Related: Scholarships 101: Getting Free Money for College

2. The student’s college savings

Saving for college requires planning. If you’re one of a small group who has accumulated money for college, it’s time to put it to work. Maybe you've been saving your graduation money, or you've received birthday funds over time. Maybe Grandma even left you some money to pay for college when you were younger. If you have your own student savings, using it to pay for college is a great first step.

3. The student’s earnings

Additionally, using your current income will help cut down on any loans you might need. If you don’t have any savings, use what you can from your current income to help fund college. A lot of students forget that they can earn money before going to college or even work on or off campus.

4. Your parents’ college savings

Next on the list is any money your parents may have put aside for school. Many parents have started saving for college for their students at a young age. Leveraging money in a tax-deferred plan like a 529 savings account can be a great way to pay for the majority of school (if the money is there). Your parents might also have other savings set aside for your education. It's important to have conversations about parental contributions early so everyone involved in the "paying for college" debate knows what to expect.

Related: Everything Parents Need to Know Before Opening a 529 College Savings Plan

5. Your parents’ current income

Along with a student's income, a parent's income is also a primary source of paying for college. Even if parents have saved a lot, they may be able to contribute a little bit toward the cost of college every year simply through their current salary. Some parents may be able to contribute much more than others, but every little bit that can be sent in to avoid borrowing for school is a huge win.

6. Fellowships and assistantships

If you’re attending graduate school, a fellowship is a great source of funding. These positions are awarded to graduate students based on merit and allow you to focus on your studies rather than having to work or teach. Fellowships do not have to be paid back. While they are prestigious, don’t think you aren’t qualified for a fellowship—they are certainly worth applying to. Speak with your educational counselor or advisor about which ones may have the highest potential for successful acceptance. Assistantships are also usually reserved for graduate students. These programs are similar to work-study (see below), except they are teaching positions in which you’ll teach lower-level classes in an area you’re familiar with.

7. Aid through school work-related programs

At this point, you’ve exhausted all forms of funding that don’t require work exchange or loans. We’re now moving into funding sources that will require some sort of payback. Work-study programs are common on college campuses and are usually tied into your financial aid package. They allow you to work on campus within your class schedule. Pay is usually minimum wage, but you can’t beat the flexibility provided by these programs. While it’s a smaller source of funding, depending on your class schedule, it might be the only type of job you can take on.

Related: What Is Work-Study? Your Top Questions, Answered

8. Federal student loans

We’ve come to one of the last options as a source for funding college. A loan must be paid back, will accrue interest, and often has some type of origination fee. For many students and families, it’s difficult to avoid taking on loans. Federal loans have fairly low interest rates, which often do not exceed the single digits. Regarding loans for college, you aren’t likely to find a better deal anywhere else.

9. Private student loans

Private loans are another and final option. These may be loans from banks or other lenders that are non-government based. They typically have higher interest rates than government loans and won’t provide the same advantages such as loan forgiveness, hardship options, and flexible repayment plans. Private student loans should really be a last resort, and before borrowing, you should really do a full Return On Investment Calculation of your college expenses to see if it’s worth it.

Related: Don't Fret the Debt: 5 Ways to Conquer Student Loans

Paying for college can be a challenge. It's a huge sum of money, and there are a lot of different ways to go about it. But even those most expensive colleges have the potential to be significantly more affordable with financial aid. The bottom line is that you don't need to borrow the entire amount for school—there are many ways to pay for college if you work at it.

Read the full article here, and avoid student loans as much as possible by using our Scholarship Search tool, featuring over $7 billion in awards!